TRID - Integrated Disclosures; Loan Estimate and Closing Disclosure Policy Sample

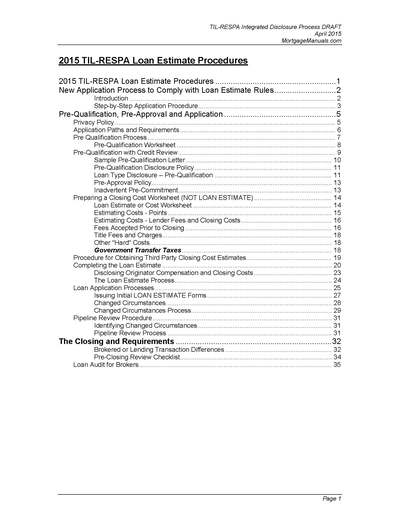

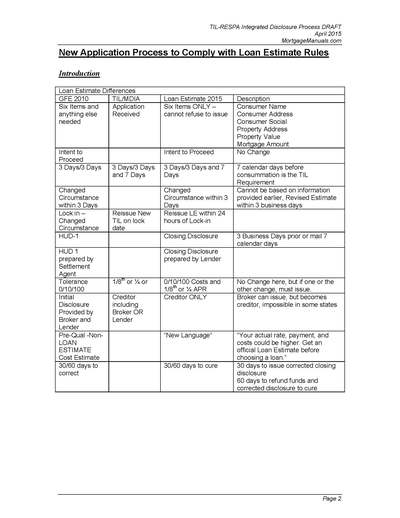

Effective 10/3/2015, the combined disclosure rule requires the consolidation of Truth-in-Lending and Real Estate Settlement Procedures Act requirements for content and timing. This primarily means that the most rigorous elements of both rules now apply to one process. Timing and content must be set forth in any standard process, but more critically, the rule sets forth specific deadlines for curing errors. This makes the audit process critical for ensuring compliance.

LE or GFE?

A common misunderstanding surrounds the appearance of the Legacy 2010 GFE within a TRID policy, which many reviewers perceive as representing an outdated policy. In fact, GFE and TIL still exist for a large portion of consumer lending products; Home Equity Lines of Credit, Home Equity Conversion Mortgages (HECM/REverse), lot loans and mobile home loans all still utilize GFE and TIL disclosures. Our policy provides a decision tree process, so you will still see CORRECT references to GFE and TIL.

Request a FREE sample TRID policy

Request Free TRID/LE Sample Policy

Click on the Google+ or Facebook icon to browse to our page. Once we see you have liked it or followed us, we will send you the free policy!